How to prepare a financial statement the right way Expensify

They offer a comprehensive overview of an organization’s financial condition, including details about its profitability, cash flow, and overall worth. Overall, financial statements are foundational for making informed business decisions and ensuring the sustainable growth of a company. Through financial statements, companies can identify trends, manage risks, and allocate resources more effectively, making it possible for them to maintain stability and achieve long-term growth.

Then assemble this information into packets and distribute them to the standard list of recipients. Conduct a bank reconciliation, and create journal entries to record all adjustments required to match the accounting records to the bank statement. This is an essential activity, since there are always reconciling items on the bank statement. For instance, banks often want basic financials to verify the a company can pay its debts, while the SEC required audited financial statements from all public companies.

- For example, if the company revalues an asset and it’s worth less, it’s the company’s loss.

- Financial statements provide a comprehensive overview of a company’s financial performance, position, and cash flows, aiding in decision-making and financial analysis.

- After you process all of your financial statements, you can use the information to track your business’s financial health and make smart, informed financial decisions for your company.

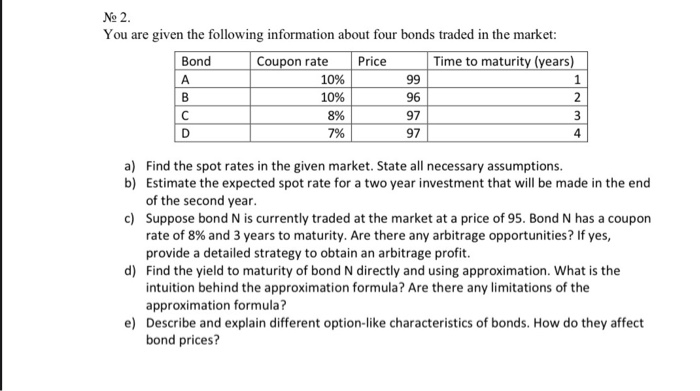

All debits have corresponding credits – of equal amounts – according to double-entry accounting. For this reason, a trial balance is built to check if the debits and credits are equal; if the total debit and credit amounts are different, you’ll need to check for arithmetic errors. Break down the data into categories such as revenue, expenses, assets, and liabilities.

Step 3: Prepare the Statement of Changes in Equity

Next, in the order of financial statements, is the statement of retained earnings. Use your net profit or loss from the income statement to prepare this next statement. After you gather information about the net profit or loss, you can see your total retained earnings and, if applicable, how much you will pay to investors. The first in the order of financial statements is the income statement.

Step 3: Prepare the Balance Sheet

This process involves collecting information on transactions, such as sales, expenses, investments, and borrowings, and organizing it in a systematic manner. Last but not least, use all of your financial data from your other three statements to create your cash flow statement. Your cash flow statement shows you how cash has changed in your revenue, expense, asset, liability, and equity accounts during the accounting period. The process of preparing financial statements begins with collecting all your financial details and organizing them into official documents. Once polished and finalized, they’re shared with key stakeholders, such as management, investors, and creditors, who use them to assess the company’s performance, cash flow, and financial health. Service Revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the Adjustments column.

As you create your balance sheet, include any current and long-term assets, current and noncurrent liabilities, and the difference between your assets and liabilities, or equity. Auditors provide assurance on the financial statements by issuing audit what are payroll taxes and who pays them opinions that indicate the level of confidence in the accuracy and fairness of the financial statements. This process helps maintain trust among stakeholders and ensures that the financial statement preparation adheres to the required guidelines and principles.

Track your finances for free by signing up today

If there is a difference between the two numbers, that difference is the amount of net income, or net loss, the company has earned. Unearned revenue had a credit balance of $4,000 in the trial balance how charities make money column, and a debit adjustment of $600 in the adjustment column. Remember that adding debits and credits is like adding positive and negative numbers. This means the $600 debit is subtracted from the $4,000 credit to get a credit balance of $3,400 that is translated to the adjusted trial balance column. After all, preparing financial statements requires a working knowledge of accounting concepts like double-entry accounting, accrual basis accounting, and the accounting cycle. Yes, bookkeepers can (and likely will) prepare financial statements.

Integrated Accounting Software: What It Is & How To Best Use It

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal extraordinary items on income statement is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.