Best Accounting Software for Small Business in 2020

Whether you are a business owner starting a brand new small business or moving your existing books online, how to write a nonprofit case for support including examples we have several QuickBooks Online subscription options to fit your needs as your business grows. Small business owners get more deductions with AI-powered expense tracking and receipt matching. Its two-way, real-time sync with every QuickBooks version tackles the jobs humans can do, but don’t want to. QuickBooks also offers a 30% discount on its Essentials, Plus, and Advanced plans for your first year. What’s more is that QuickBooks Enterprise offers industry-specific features unique to your business sector.

QuickBooks Online Additional Fees and Features

Contractors should also select Plus to track the profitability of individual projects. Other businesses should consider whether tracking P&L by class and location is worth the extra $34 per month. Meanwhile, Essentials gives you access to more than 40 reports, including those you can generate in Simple Start. Its additional reports include A/P and A/R aging details, transaction lists by customer, expenses by vendor, uninvoiced charges, unpaid bills, and expenses by supplier summaries.

- This ensures that their payments are tracked separately for 1099 reporting purposes.

- Simply put, if you need a rock-solid, feature-packed accounting solution at a fair price, QuickBooks is the best.

- It is also suitable for those doing business outside the US, as it supports multiple currencies, unlike Simple Start.

- Advanced users receive better customer support through its Priority Circle membership.

It covers up to 25 users and provides dedicated customer support and advanced reporting features. QuickBooks is a well-established accounting software that is widely used by businesses from a variety of industries. With five plans, each at different price points, users can choose the plan that best meets their business needs without paying for additional features that they don’t want. As a business grows, users can easily upgrade to a more advanced plan c corporation taxes with additional features seamlessly.

QuickBooks Plus vs QuickBooks Advanced

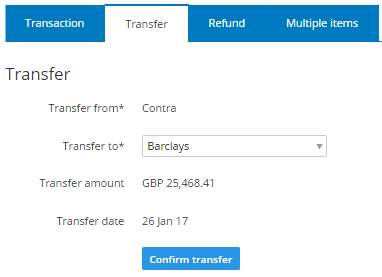

QuickBooks Online payroll costs between $50-$130/month plus $6-$11/month per employee. If your small business needs a payroll solution, be sure to add this cost to the regular QuickBooks Online monthly fee. Read our complete QuickBooks Online Payroll review for the details, and be sure to visit the QBO website to see if Intuit is running a QuickBooks payroll discount before buying. The QuickBooks Online Simple plan costs $35/month and supports one user.

Wave Payments: Is Wave’s Invoicing & Payment Processing Service A Good Solution For Contractors?

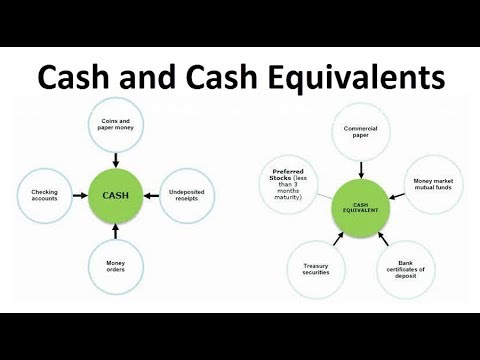

Key features are the ability to track income and expenses, photograph and organize receipts, estimate quarterly taxes, send invoices, accept payments, create basic reports, and track miles on the mobile app. 61% of freelancers today say their biggest problem is landing clients, so streamlining their process can clear room in their schedule to pursue their next gig. This takes into account customer management, revenue recognition, invoice management, and collections. QuickBooks Simple Start is a double-entry accounting system, which is an advantage over QuickBooks Solopreneur. You can create basic comparable store sales asset and liability accounts in the chart of accounts (or use the existing ones) to track things like bank accounts, cash on hand, A/R and A/P, credit card balances, and loans.

The Essentials plan is a great fit for growing small businesses that have an increased number of suppliers, employees, and clients. The best QuickBooks Online plan for you depends on the size of your business and your particular needs. If you deal with inventory or large projects heavily, Plus is the best option. However, self-employed individuals and solo business owners should consider Solopreneur—unless you have an employee, which will require an upgrade to Simple Start. A notable new feature is Spreadsheet Sync, which helps you generate consolidated reports across multiple entities easily.

Can Method help migrate data between QuickBooks versions?

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication.

Based on the depreciation method you choose, Advanced automatically calculates the depreciation for the fixed asset and creates a depreciation schedule. With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. Our internal case study compares the four standard QuickBooks Online plans for small businesses across major accounting categories and functions to help you decide which one fits your needs. We excluded QuickBooks Solopreneur because it’s not a double-entry accounting system. Hopefully, knowing the exact costs of QuickBooks Online will ease your mind and help you create a more realistic business budget.

Once you’ve recorded your billable time, you can add it to your invoice and then send it to your client. This feature is ideal for service-based businesses that charge work by the hour, such as lawyers and independent contractors. To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics. This hands-on approach helps us strengthen our accounting software expertise and deliver on the Fit Small Business mission of providing the best answers to your small business questions.

Users can tailor their reports by filtering and grouping data and creating custom fields and dashboards. Additionally, Advanced lets you generate multi-company reports and schedule emailed reports to be sent to specified email addresses. QuickBooks Simple Start has a decent ability to record and track payments to independent contractors, making it easier to stay compliant with tax regulations. When you add a new vendor, you can designate them as a 1099 contractor. This ensures that their payments are tracked separately for 1099 reporting purposes.